It’s estimated that one in three Kentuckians struggles to pay medical bills, and the issue continues to be a driving factor in personal bankruptcy cases. Local organizations are working to address the issue by partnering with debt-buying agencies to relieve residents’ medical debt.

Reverend Kent Gilbert, pastor of Union Church in Berea, said during the pandemic, several churches teamed up with a debt consolidator to eliminate millions of dollars of medical bills. He said without boosting consumer protections, such as those enacted recently to stop surprise medical billing, the problem will worsen.

“What this really tells us is that we need to stop this debt from happening in the first place, and I think that should be our ultimate goal,” Gilbert continued.

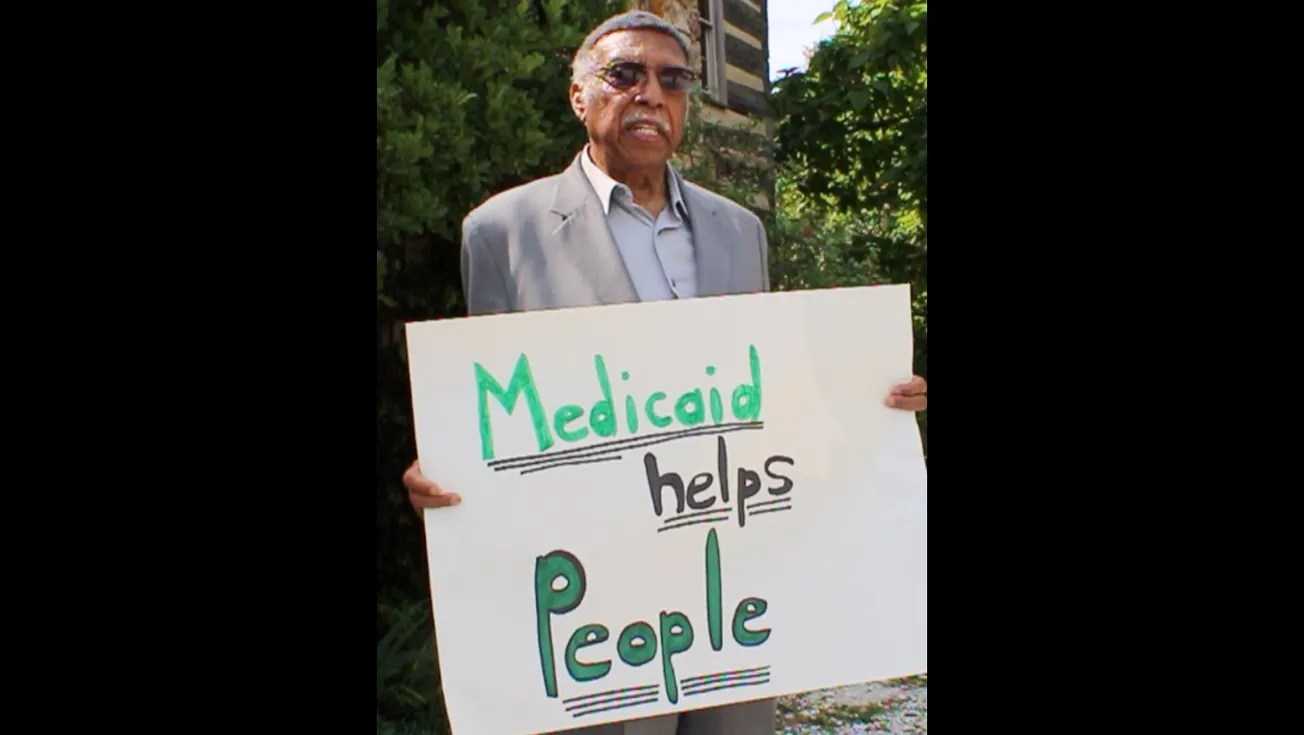

Research shows Black Americans, people living in the South, and those living in states that have chosen not to expand Medicaid are more prone to carrying significant medical debt.

Kentucky Voices for Health is also tackling the issue by partnering with RIP Medical Debt, a charity that uses donations to forgive delinquent debt. For more information visit KYVoicesForHealth.

Kelly Taulbee, director of communications and development with Kentucky Voices for Health, said while systemic changes are needed to address skyrocketing health-care costs, many Kentuckians need immediate help paying bills. She explained that through her organization’s partnership with RIP Medical Debt, $1 donated helps eliminate more than $100 in medical debt. She said eligible cases are identified using consumer data from health-care providers to locate accounts that meet the criteria for debt relief.

“Donations made completely abolish that medical debt, no strings attached, no tax consequences. These portfolios are bought at a fraction of the original costs, and then once the debt is relieved, recipients are notified that their debt is gone,” Taulbee said.

A 2018 consumer survey found 72% of Kentucky adults have struggled with health-care affordability. In eastern Kentucky, nearly 80% of people reported having problems and 1/3 said they’d been contacted by a debt-collection agency.

--30--

Written by Nadia Ramlagan for KY News Service.