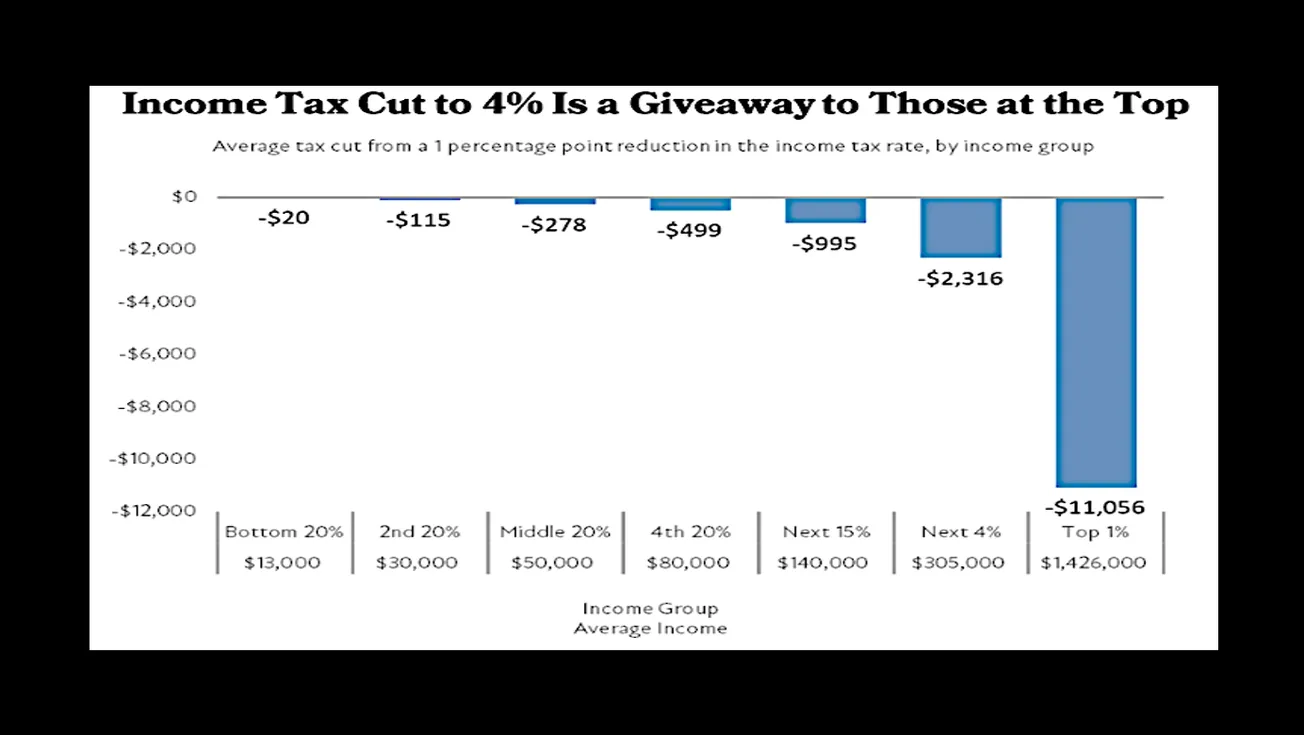

House Bill 1 passed out of the Kentucky House today, moving the state one step closer to reducing the income tax to 4% at the start of 2024. This bill is a giveaway to the wealthiest Kentuckians that will strain the state budget over time and jeopardize future investments in schools, health, housing, and other needs across the commonwealth.

The cut will result in a $1.2 billion loss to the General Fund by 2025 and the benefits will flow overwhelmingly to the wealthy. The wealthiest 1% of Kentuckians, who make $1.4 million a year on average, will get an $11,056 annual tax cut from reducing the income tax rate to 4%. The poorest 20% will just get $20 a year on average.

The state is experiencing large revenue surpluses, but those are driven by temporary factors including aggressive federal pandemic aid and COVID-induced inflation. The effort to reduce and even eliminate the income tax will leave a big budget hole that will lead to dramatic cuts to vital programs, large new sales taxes that would disproportionately harm low- and middle-income Kentuckians, or both.

Rather than fund lavish tax giveaways to the wealthy, the legislature should use the current surpluses to make critical and transformative investments in the commonwealth and protect key services in the future. Kentucky needs resources to invest in public schools, build homes for our neighbors devastated by natural disasters, pay teachers what they're worth, allow every child to access pre-K and every family access to affordable child care, and improve health across the commonwealth.

--30--