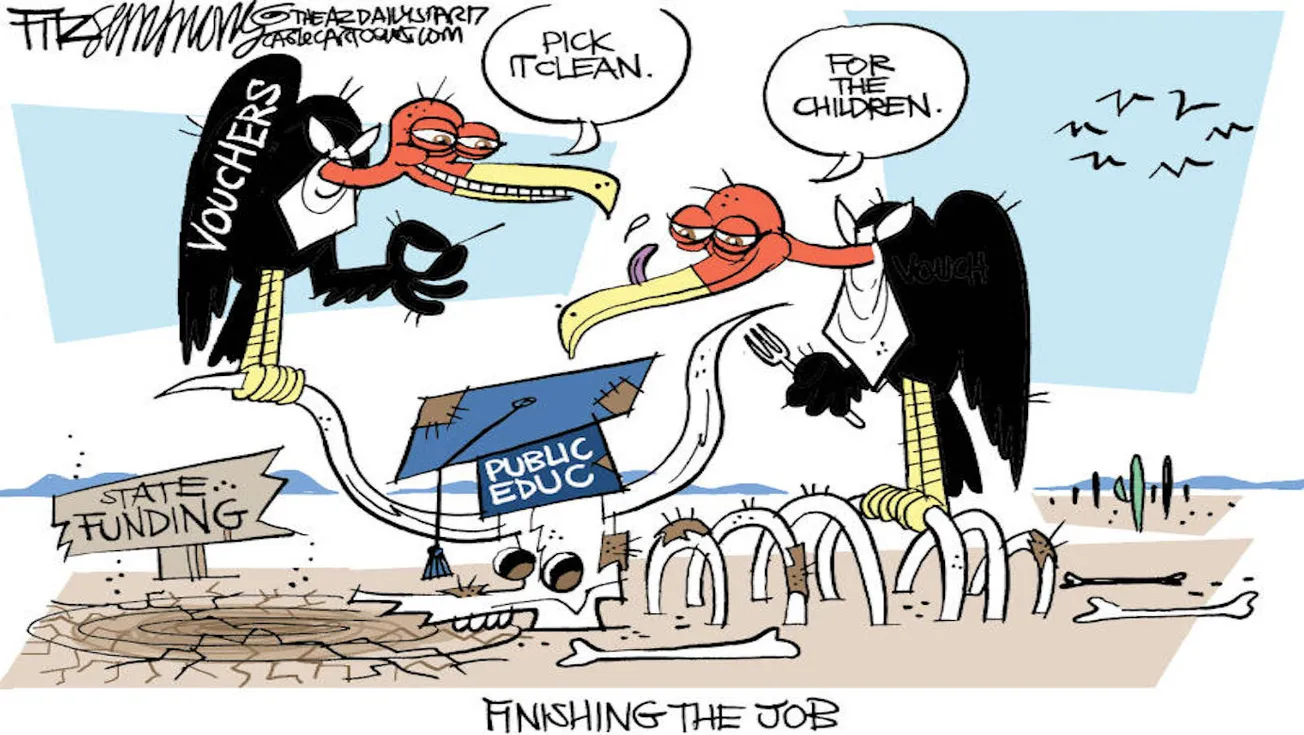

A statement from KEA President Eddie Campbell regarding HB305 and SB50 School Voucher Bills:

“These recent private school voucher bills introduced in the general assembly are yet another attempt to remove much-needed funding from our public schools and public school students by diverting it through “scholarship tax credits” that allow wealthy individuals and corporations to “donate” money in return for favorable tax refunds.

“These are bad bills. They’re bad for the 90 percent of our children who attend our public schools. They’re bad for the taxpayers of Kentucky. They’re bad for the communities who will pay for these ‘tax refunds,’ and they’re bad for those kids who can be refused entry to a private school because they may not meet a required or desired criteria.

“This scheme to undermine Kentucky’s constitution has already been litigated in court. It was confirmed by Franklin Circuit Court Judge Phillip Shepherd last October that this tax credit scheme is an unconstitutional attempt to circumvent Kentucky’s constitutional requirement to appropriately fund public schools.

“This latest attempt is even more brazen in its reach, which could include more than $100 million each year in lost tax revenue for the commonwealth, all of which would be redeemed in tax credits to those who donate to this voucher system.”

--30--