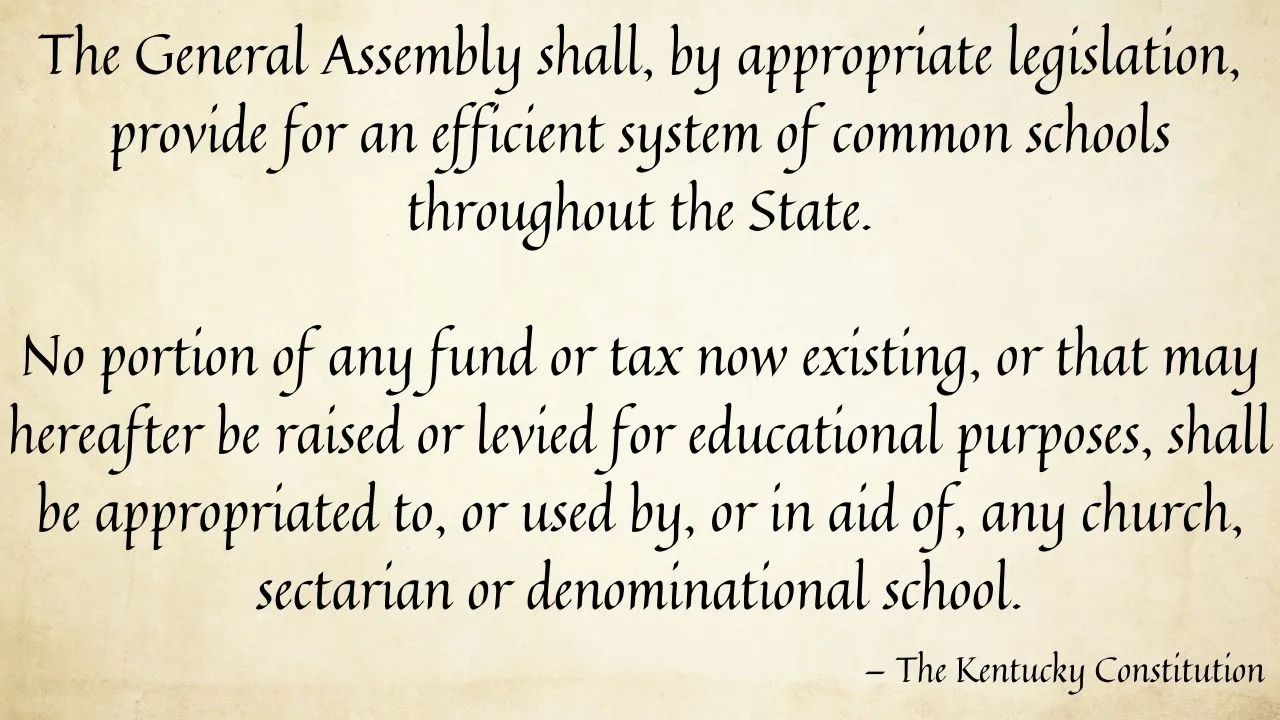

The framers of Kentucky’s constitution made crystal clear the state’s responsibility to provide for a system of common, public schools across the commonwealth. And in 1989 the Kentucky Supreme Court affirmed that obligation and said funding inadequacies at the time meant the state had “fallen short in its duty” to provide a “proper and adequate education.”

The General Assembly followed the decision with a recommitment to better funding and more than a decade of progress. But repeated state budget cuts and funding freezes since 2008 have turned the clock backwards.

In 2018, we surveyed superintendents and found that, because of these funding reductions, 54% of respondents had cut instructional time, 42% had reduced student supports like intervention and enrichment services and summer school, 30% had eliminated course offerings and 14% had reduced special education services, among other damaging impacts.

This is the context in which certain special interests are fighting in court to protect a program, set up by House Bill 563, that takes money available for Kentucky’s public schools. It gives those resources instead to private schools despite the constitutional prohibition against public aid to such schools. This week, arguments are taking place in Franklin Circuit Court in the Council for Better Education’s lawsuit challenging the constitutionality of HB 563.

Instead of giving handouts to select private schools, shouldn’t we be restoring funding for public schools? After all, research shows that state funding for things like smaller class sizes, increased instructional time and other educational supports improves student outcomes in districts with less local resources. Yet we’re currently spending nearly $3,000 less per student in state and local resources in Kentucky’s poorest counties than we are in wealthy ones.

The logic of HB 563 seems flawed, unless one realizes that its point is not ensuring access to a high-quality education for all Kentucky children as the constitution mandates, but bolstering resources available for private education in select communities.

Taking more money out of our public schools — that must serve all students despite dwindling state support — and giving it to private schools that can pick and choose who they serve is unconstitutional. Want a better idea? Reinvest in our public schools.

The 2021 Kentucky General Assembly passed HB 563, setting up the richest state tax credit on the books which allows private interests to divert money from the General Fund to private educational institutions at little or no cost to themselves. For giving to an Account Granting Organization (AGO), “donors” get back at least 95% of their contribution, and are able to actually make a profit, receiving more than they give if they donate stocks that have appreciated in value. As a point of comparison, Kentuckians who give to veterans’ organizations, churches, animal shelters and other nonprofit institutions get a tax reduction worth at most just 5% of the amount contributed if they itemize deductions on their taxes.

AGOs distribute these diverted public funds to families to use for various educational purposes. In the state’s eight largest counties, which tend to be urban and more affluent, monies can be spent on tuition and fees at private schools. In other counties, funds can’t go to tuition, but can pay for expenses at private schools like uniforms, textbooks, curricula, tutoring, after school and college test prep courses.

Unlike public schools which are mandated to serve all Kentucky students, under the program set up by HB 563, private entities can pick whom they do and do not serve. The state has opted to exercise little supervision over AGOs and the service providers they work with. AGOs can define services they cover, and in which communities. Private school students do not have the same protections as public school students against discrimination based on disability, LGBTQ status, race, religion or being an English language learner, for instance.

Those fighting to protect HB 563 say it targets those with the greatest financial need, but the program’s eligibility threshold is so generous that 63% of Kentucky children are eligible on a first-time basis, and resources are prioritized for past recipients even if their family income grows to 463% of poverty — meaning a family of 4 with $121,175 in annual income can receive funds.

Research on similar programs in other states shows that the most affluent families eligible tend to benefit most. That’s because families with means face the fewest barriers to participation. Parents in rural communities with access to fewer educational alternatives, those who work two or more jobs, who can’t afford to pay for private school costs not covered by the program, and who have limited access to internet and transportation face more barriers. Other states that have this kind of program have also seen them grow, draining a larger and larger amount of revenue from what’s available for public schools, libraries, community health and other public services for everyone.

Taking more money out of Kentucky’s public school system — a system that must serve all students despite dwindling state support — and giving it to private schools that can choose whom to serve is far from aligned with Kentucky’s constitution. The best use of public resources toward improved outcomes for students in underserved communities is to reinvest in our public schools and in struggling students.

--30--

Written by Anna Baumann, who is Deputy Director at the Kentucky Center for Economic Policy.