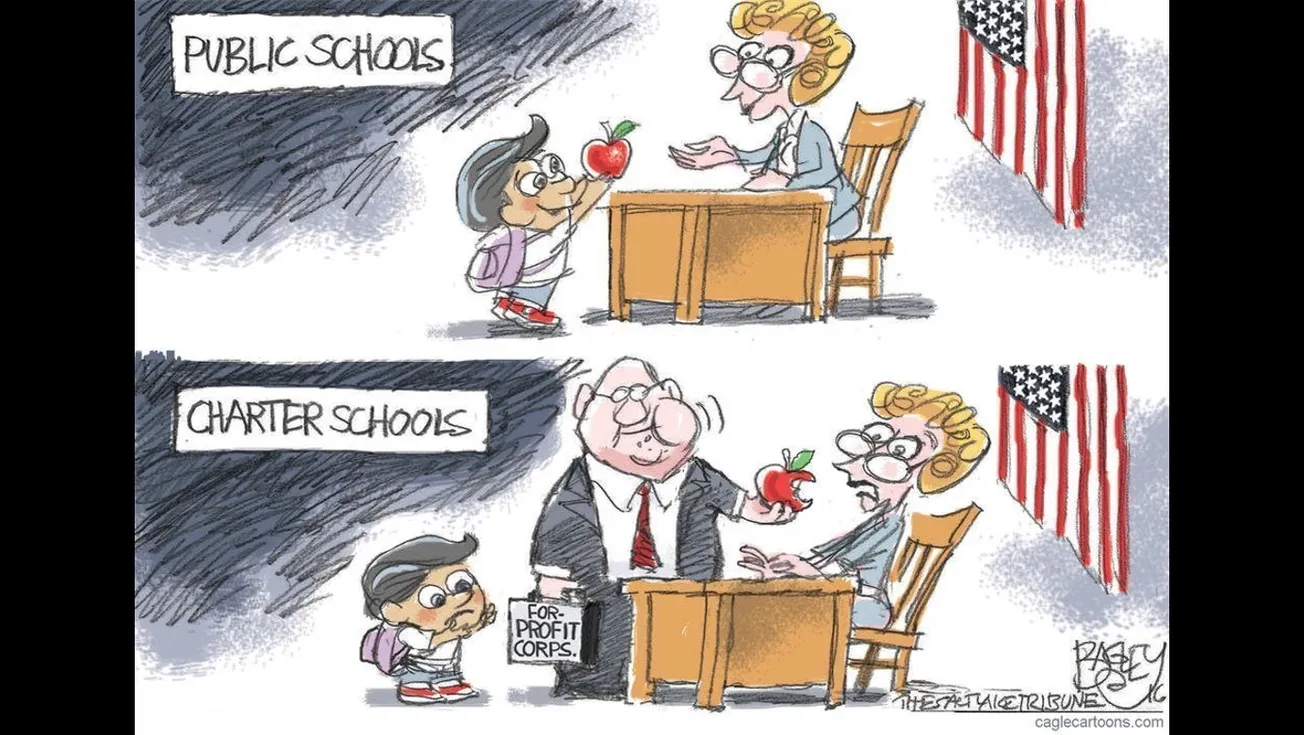

Ample public investment in K-12 education is essential for Kentucky’s children to thrive. But instead of committing to funding the many different components of successful public schools — including skilled teachers, up-to-date instructional materials, non-academic supports, and safe learning environments — state lawmakers have begun moving in the opposite direction.

For over a decade, the legislature has eroded funding for public education with budget cuts. Then in 2021, lawmakers passed House Bill 563 (HB 563), taking millions out of the state budget to fund private education. That’s both a misuse of state resources and at odds with the state constitution, which requires “an efficient system of common schools throughout the state” and bars state funding of private schools without a vote of the citizenry.

HB 563 attempts to skirt the constitution by creating a complicated tax scheme that diverts public money to private schools. The program allows donors to give money to private school intermediaries called account granting organizations (AGOs), which then use that money for administrative costs before spending what’s left on tuition and fees for students to attend private schools. Under HB 563, donors can get a nearly one-to-one state tax credit for money given to AGOs, diverting the taxes they owe the commonwealth to private schools.

The Franklin Circuit Court has already found HB 563 unconstitutional, and last week, the Kentucky Supreme Court heard oral arguments in the case. During the hearing, Chief Justice John D. Minton Jr. expressed skepticism about the program.

“Why is this not just flat out not an appropriation?” he asked an attorney arguing in favor of the program.

Over the summer, we at the Kentucky Center for Economic Policy filed a friend of the court brief outlining the program’s unconstitutionality. The brief explained that the attempt to hide a new unconstitutional appropriation for private schools in the tax code fails to pass constitutional muster for two primary reasons.

The first is its size. HB 563 allows taxpayers who “donate” to AGOs to erase as much as 97% of their tax liability, and over 100% if they donate appreciated financial securities. A tax credit is different from and more valuable than a deduction because it’s a dollar-for-dollar reduction in taxes due, rather than a reduction in the amount of income subject to tax. As far as tax credits go, none is this generous.

The second reason HB 563 is unconstitutional is its prescriptive design. It adds more than a dozen new statutes creating a new government program that funnels money to private schools. It differs from other government programs only in its funding source – a tax expenditure as opposed to an appropriation.

The diversion of public money to private schools also arrives at a moment when Kentucky’s public schools remain underfunded. Since 2008, the state’s per-pupil contribution to school districts has dropped significantly when adjusted for inflation. The lack of state funding has shifted the burden to local districts, which are shouldering more of the cost, leading to increasing funding inequities between wealthier districts and those with a smaller tax base, and bringing us back close to where we were when the entire system was declared unconstitutional in part due to inequitable funding.

While poorer districts have been disproportionately harmed by state funding cuts, all districts across the state have borne the weight of these cuts. Districts have been forced to reduce course offerings, student supports, and the number of staff. In nearly all districts, salaries of educators have suffered. The state also provided no funding for textbooks and professional development in the current budget, and continues to underfund district transportation costs despite a statute that requires the state to pay 100% of these costs.

HB 563 will also allow public resources to be spent by entities that do not have the same legal mandate to serve students no matter where they live, and to protect students from discrimination based on having special needs, their LGBTQ status, race, religion, or being an English language learner, for instance.

The best use of public resources to support improved outcomes for all students, particularly those that are struggling and those who live in underserved communities, is to reinvest in our public schools. The program established by HB 563 instead unconstitutionally siphons more resources away from our already underfunded public schools to the detriment of all of Kentucky’s kids.

--30--

Written by Pam Thomas, who is Senior Fellow at the Kentucky Center for Economic Policy. Cross-posted with permission from KYPolicy.org.

Comments