We are about to see a financial disaster in Kentucky. The Kentucky General Assembly, dominated by Republicans, may soon see the Senate join with the House in approving the infamous House Bill 8.

HB 8 reduces the state income tax rate from 5% to 4% and then “includes triggers to cut the tax rate by 0.5% each time revenue exceeds arbitrary dollar levels, until the income tax is completely eliminated,” according to Jason Bailey, director of the Kentucky Center for Economic Policy.

Before you cheer too loudly for this income tax reduction, which is called “tax reform,” consider the fact that most of the state income lost from this reduction is not being replaced. The bill does include a few new taxes on services such as security systems, event planning, and electric and hybrid vehicles, but the total raised from these sources makes up for only 10% of the revenue lost by the tax cut in the first year.

This lost income, by the way, is equal to all of the money Kentucky currently spends on universities and community colleges, something that should be of interest to President Bob Jackson at Murray State and other university presidents.

If not vetoed, and the veto sustained by “on second thought” Republicans, this law will create a hole in our budget revenue that will grow to equal the entire Medicaid program which serves over a million kids, senior citizens, and others with low income or disabilities.

There will then be a clamor, especially, from Republicans, to replace this lost state revenue by increasing the sales tax rate. After all, they will say, Tennessee doesn’t have an income tax, and they are surviving financially.

The problem with comparing Kentucky with Tennessee and other no-income tax states like Florida is that, unlike those states, we do not have the tourist trade of those states, which enhances their revenue. Because we no longer produce as much coal, that resource is no longer a source of new tax revenue either. And higher sales taxes, we know, negatively affect the poor since they spend a larger portion of their income on everyday commodities and service.

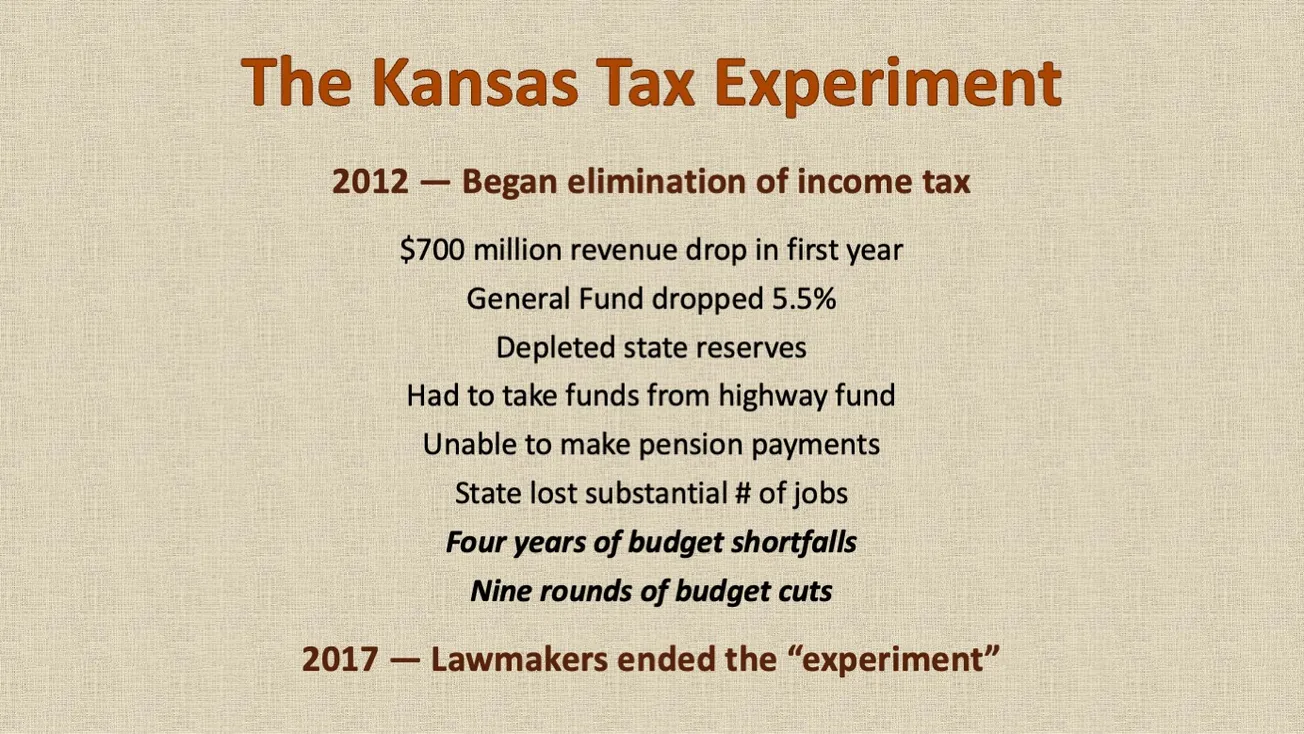

It is fairer to compare Kentucky with Kansas, which in 2012 reduced their income tax rates and eliminated some income tax credits and raised the standard deduction (an action popularly known as the “Kansas experiment.” As a result, state revenues fell by hundreds of millions of dollars by 2017, causing cuts in state spending on roads, bridges, and education.

The economic growth that Kansas expected from the tax cuts did not develop, and this great experiment in supply-side or “trickle-down” economics, once hailed by conservatives throughout America, was ended by the legislature five years after it began, due to the outcry of citizens over the budget cuts that had to be made. Less taxes did not result in more jobs and spending.

Why do Kentucky Republicans want to imitate this Kansas failure?

Clearly our Republican legislators want to give more money to the wealthy at the expense of those in the middle and lower classes. The Kentucky Center for Economic Policy produced a chart showing that those in the middle-income range (40 to 60 percent of us) with a salary of $50,000 would save $278 in taxes from this “reform,” while those in the top 1 to 5%, with income ranging from $305,000 to $1,426,000 (top 1%) would save between $2,316 and $11,056 in taxes.

The tax savings for the 1% is “40 times more than the middle class, so yeah, the wealthy LOVE this bill,” reports Bruce Maples, webmaster at Forward Kentucky, a website I highly recommend.

If you favor regressive taxes, which fall most heavily on the middle and lower-class citizens of our state, you will like this new law.

The rest of us deplore it.

In the words of Jason Bailey, this is “the most fiscally destructive legislation ever considered in the commonwealth. It tries to get something for nothing by phasing out the income tax, which generates 40% of state revenue, without providing a way to pay for it.”

Call your state legislators and tell them to stop this train wreck!

--30--

Comments