“Yay! They’re cutting my taxes!”

That is most likely the reaction of Kentuckians when they hear about House Bill 8, the so-called “tax reform” bill pushed by Republicans in Frankfort.

And who can blame them? We all want to pay less taxes, right?

What these same people don’t realize is that, unlike the federal government, Kentucky’s state budget has to be balanced. So, if you lower one source of revenue for that budget (income tax), our shared state government only has three options:

- Increase other sources of revenues (like sales taxes).

- Cut spending and services provided to us, the citizens (like schools and roads).

- Do both.

In short, HB 8 is a disaster with a smiling face, that will wind up hurting almost all of us in Kentucky.

Why, then, would Repubs be so foolish as to do this? Because of the very small group of people this bill benefits.

I’ll get to who benefits in a moment. First, let’s look at what is going to happen if this bill passes.

The problems with relying on sales taxes alone to fund the work of our state

For years, the GOP has been saying we should do away with the income tax, and instead tax on “consumption.” In other words, we should fund our state budget through sales taxes and other fees.

They point to states like Tennessee that have no income tax, and say “See? It can be done. Let’s be like Tennessee!”

Yeah, sounds great. Until you realize that we are NOT like Tennessee, or the other no-income-tax states. As Pam Thomas from KCEP told me in an email:

If we shift away from income taxes, Kentucky could be left in even worse fiscal shape than other states that have much different economies.

For example, states without income taxes like Florida, Tennessee, and Nevada have much bigger tourist economies due to specific local amenities (including beaches, the Great Smoky Mountains, and the Las Vegas strip, respectively), while no-income tax states like Texas and Alaska have large natural resource sectors that no longer exist in Kentucky due to the decline of coal. Those unique conditions create particular opportunities to raise significant revenues from other sectors of the economy in those states – sectors that Kentucky lacks, meaning the commonwealth cannot follow these states without substantial harm to its budget.

Another problem is that sales taxes are very regressive, unlike the income tax. What this means is that they have a much greater impact on you the lower your income is. Here’s what we mean:

Let’s assume it costs $20,000 a year for essentials that a family of four has to have, no matter their income level. If we then tax those purchases at 6%, every family is paying $1,200 a year in sales taxes for their essentials.

BUT, for a family bringing home $24,000 a year, that sales tax bill is 5% of their total take-home pay. For another family bringing home $120,000, that same tax bill is only 1% of their take-home pay.

With our current flat income tax, at least both families pay the same percentage. With sales taxes, you get hit harder the less money you make.

In other words, we are funding our state on the backs of the poor and middle class.

And finally, if we get rid of the income tax, what has to happen with sales taxes to make up the difference? Again, Pam Thomas:

We hear a lot about Tennessee, but our neighboring state has very high taxes for low-income people and the working class, with a sales tax of up to 9.75% locally and a 4% tax on groceries – the highest rate in the country. It also has much higher business taxes than Kentucky and yet struggles to generate revenue, ranking 45th among states in funding for public schools compared to Kentucky at 28th.

You catch that? A sales tax of up to 9.75% locally. In other words, local governments can add on their own sales taxes on top of what the state charges. How does a state sales tax of 8% and a local sales tax of 3% sound to you?

If you follow this year’s legislative session, you know the Repubs are preparing for this. There are numerous bills that would allow the legislature to approve local sales taxes for either certain local governments or for the entire state. And once the money coming from the state starts getting cut, what are local governments going to do to keep their schools and police and everything else funded? They’re going to turn to sales taxes, just like the state did.

And if you paused at “money from the state starts getting cut,” then let’s turn to that second option to balance the budget.

You get the government you pay for.

Kentucky has multiple state budgets: the budget for roads, the budget to run the courts, the budget to run the legislature. But when people talk about “the budget,” they are usually referring to the Executive Branch Budget, which covers everything else.

Our state’s general fund — the part of the budget generated from within Kentucky via taxes and fees — is approximately $13 billion per year. The income tax generates 40% of that, or $5.2 billion. So, if you eliminate the income tax, you just cut your state budget from $13 billion to $8 billion. If you don’t make up that difference through sales taxes, then what do you do to balance the budget?

You cut.

You cut schools, you cut healthcare, you cut things like state parks and economic development and college programs and social workers and child protection workers. You eliminate entire departments and the services they provide. You overwork and underpay everyone else.

The main thing you cut is schools, because they are the leading expense of the state. Books, teacher salaries, programs, building – you name it, it goes on the chopping block. Instead of investing in our people, we tell them “sorry, you’re on your own.” That happy talk about the magic of tax cuts driving growth is gone; instead, we’re facing a fiscal disaster that moves Kentucky to the back of the pack. Again.

Learn from the Kansas Experiment

Think I’m exaggerating? Do you remember the Kansas Experiment, where the Republican governor and legislature cut taxes on everything, including income taxes, saying that the tax cuts would grow the economy enough to make up for the tax cuts.

Instead, state revenues fell by hundreds of millions of dollars, causing spending on roads, bridges, and education to be slashed. Eventually, the Republican legislature reversed the cuts, but the damage was done. In their next budget, the legislature had to deal with a $900 million gap in the budget.

So, what about Kentucky?

Fiscal note provides a warning

Republicans aren’t going for the whole enchilada in one bite. Instead, HB 8 proposed dropping the state income tax by just a half percent for now, with future cuts to the rate dependent on hitting revenue targets.

So what is the cost of that half-percent cut? The fiscal analysis on HB 8 was released a few days ago, and it should awaken everyone to the recklessness of this bill.

- For the 2023 fiscal year, that "small decrease" in the income tax rate costs the state $463 million.

- For the next fiscal year, the loss due to that "small decrease" balloons to $901 million.

$1.3 billion lost in two years! Think we could buy some textbooks with that?

This is a trainwreck of a bill. It is the worst bill in this year’s session, and quite possibly the most negatively impactful bill the Republicans have ever put forward. So why are they doing it?

It’s not about the economy.

Repubs will tell you that this is all about “jobs” and “competitiveness” and “growing the economy.” Don’t believe them. There are three, and only three, reasons they are doing this.

The wealthy

Republicans have long been the party of the near-wealthy, the wealthy, the very wealthy, and the absolutely filthy rich. So what does this bill do for their core constituency?

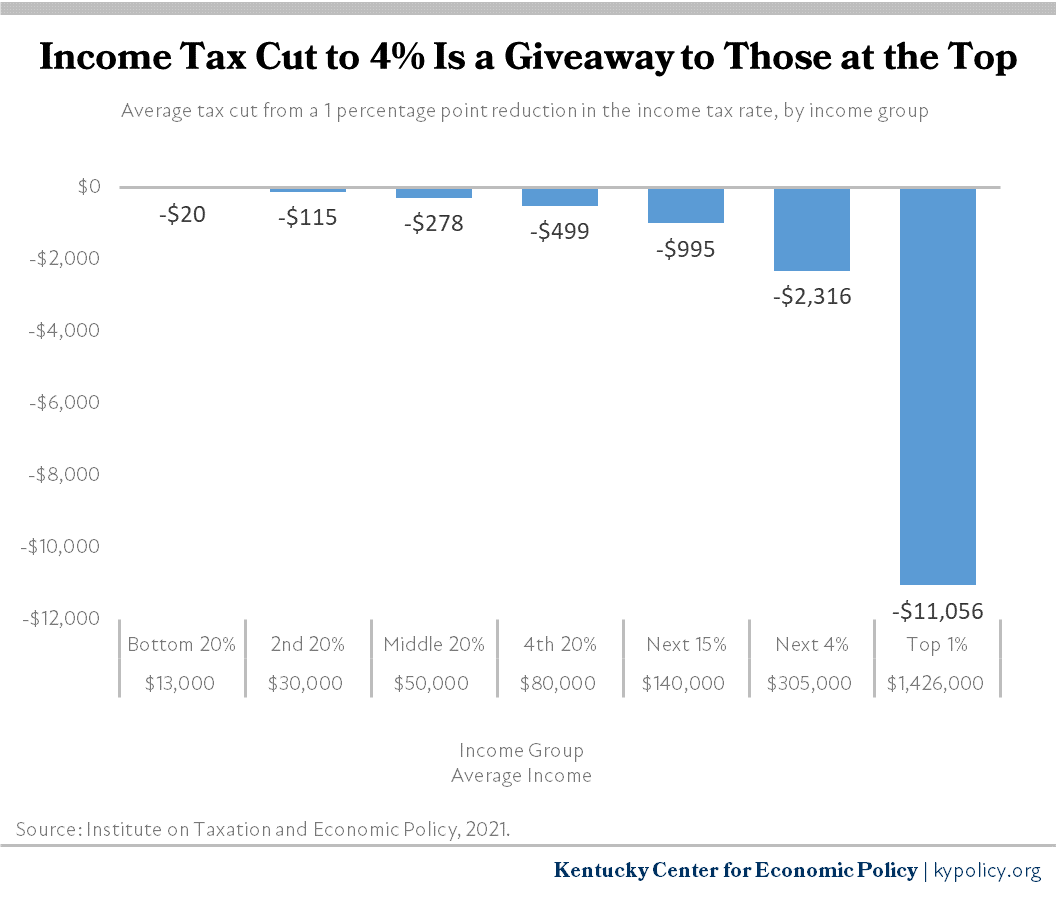

Check out this graph from KCEP:

Look at that! The “middle class” gets back $278 on their taxes (while paying much more in sales taxes), while the top 1% get back $11,056. (Note: An earlier version transposed the income and refund numbers for the 1% group.)

That’s 40 times more than the middle class! So yeah, the wealthy LOVE this bill.

Donors

A subset of the wealthy is the Republican donors. Make no mistake: the Republican party runs on money from the wealthy. And this bill is a giant gift to those donors.

If I’m going to get back an extra million every year forever, why wouldn’t I donate, say, $50,000 to a right-leaning PAC? Or to two such PACS?

The massive damage to the state doesn’t affect these donors ... and it doesn’t affect the Repub lawmakers either, who just voted themselves a raise. And neither donors nor Republican donors care a whit about what it does to you and me, or to the poor, or to the schools.

Voters

Did you forget this is an election year? Those state legislators certainly didn’t. They’ll be more than happy to shout “And we cut your taxes!” at the Repub rally in their district. Never mind that the “your” in that sentence doesn’t apply to the voters at the rally.

You watch – if this bill passes, Republicans running for re-election this fall will tout it in every speech, every ad, and every rally. And when the shit hits the fan and those same voters are apoplectic about the cuts to their local schools? The persons who caused the trauma to the state will be back in Frankfort, fat and sassy, and blaming anyone and everyone else for the damage they caused. Including, of course, Democrats and the Democratic governor.

So what can we do?

To begin with, you can share this article, and the KCEP article, with everyone you know. Get the truth about “tax cuts” out there. Help people understand that you get the government, and schools, and parks, and services that you pay for. Help people see what blowing a giant hole in the state budget will eventually do to their everyday lives. Help them see why “we are not Tennessee” – and even if we were, do they really want a sales tax rate of 10%?

Then, take the time to contact your state senator. This trainwreck of a bill has passed the House, but not the Senate. Take all the actions outlined in this article: calling the Comment Line, emailing your senator, writing a letter, and so on. Maybe we can limit the trainwreck to one chamber, instead of the entire state.

Because if it passes, the so-called “tax cuts” in it will wind up hurting you, your family, your neighbors, your town, and your state.

--30--