Via press release from the Kentucky Center for Economic Policy

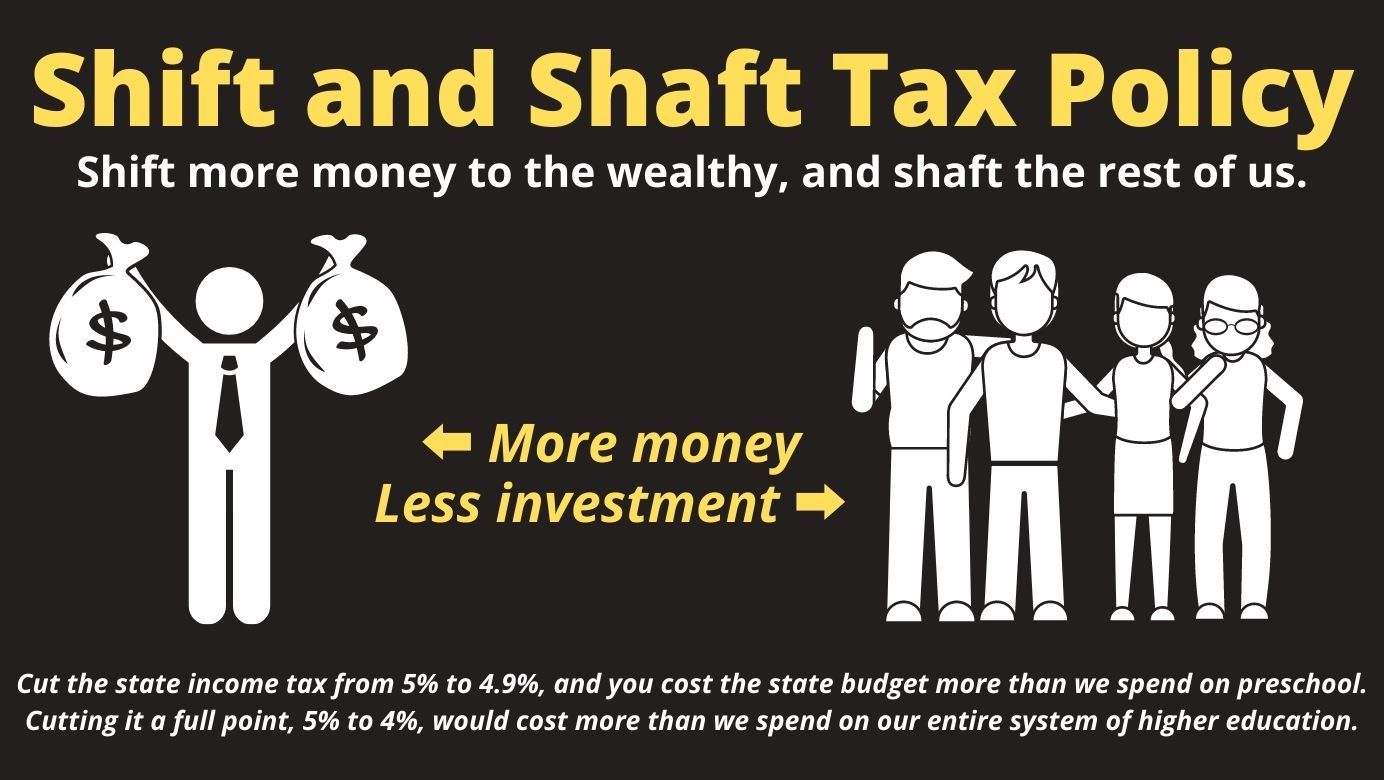

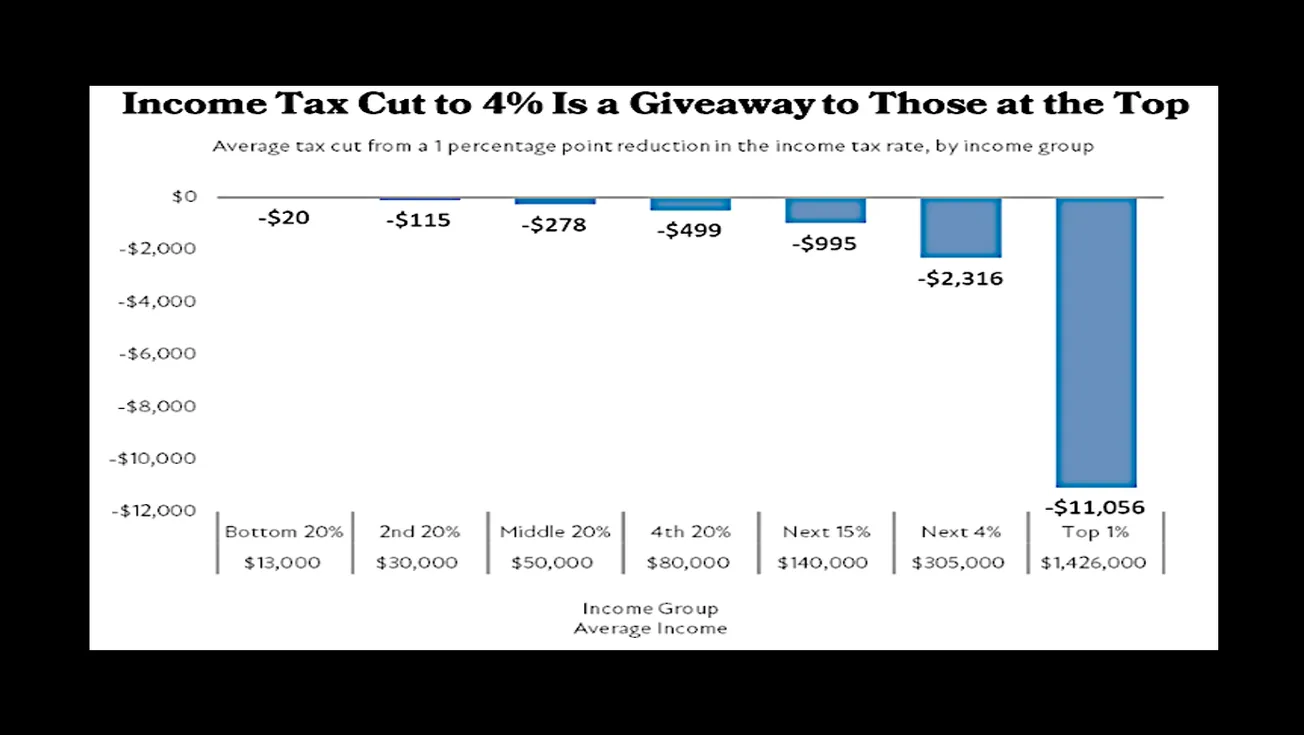

The first income tax reduction set in motion by 2022’s House Bill 8 goes into effect on Jan. 1, dropping the state’s rate from 5% to 4.5%. This move disproportionately benefits the state’s highest earners and will jeopardize future investments in schools, health, housing and other needs across the commonwealth, the Kentucky Center for Economic Policy (KyPolicy) reports.

The cut will result in a loss to the General Fund of $247.6 million in fiscal year 2023 (the 4.5% rate will be in effect for only half of the fiscal year) and $487.6 million in 2024, even after taking into account additional sales tax revenues from House Bill 8. That lost revenue is nearly nine times what Kentucky spends on educating its youngest learners in preschool each year.

The state is experiencing large revenue surpluses, but those are driven by temporary factors including aggressive federal pandemic aid and COVID-induced inflation, both of which are coming to an end. And it’s unlikely to be the last reduction. Lawmakers have signaled their intention to reduce the tax rate to 4% in the coming weeks (that would go into effect on Jan.1, 2024) and are even discussing slashing it to 3.5% in the 2024 session (that would go into effect on Jan. 1, 2025).

“These tax cuts create a dangerous budget situation down the road that will either take needed monies from our rainy day fund, force cuts to vital programs or result in new sales taxes that would disproportionately harm low- and middle-income Kentuckians,” said KyPolicy Executive Director Jason Bailey.

“The legislature should use these surpluses to make critical and transformative investments in the commonwealth,” Bailey said. “Instead of cutting taxes for the wealthy, Kentucky could invest in public schools, build homes for our neighbors devastated by natural disasters, pay teachers what they're worth, allow every child to access pre-K and every family access to affordable child care, and improve health across the commonwealth.”

--30--

Related Articles